"There is broad stakeholder consensus that audit reform continues to be necessary to restore investor and public trust following the very damaging collapse of several high-profile businesses including Carillion, BHS and Thomas Cook"

Stay informed with regulations, insights & events by joining our mailer

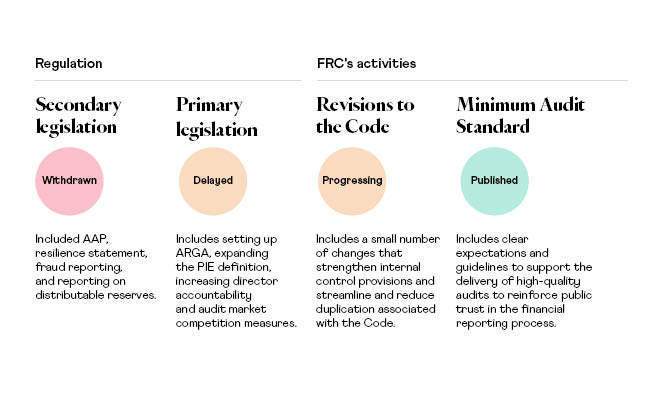

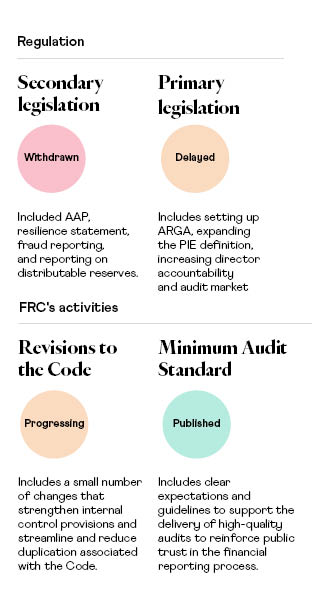

It’s fair to say that a lot has happened in the regulatory space during 2023, most notably when the Department for Business and Trade (DBT)’s draft corporate reporting regulations were withdrawn.

A core part of the proposals required companies to disclose what assurance is available for stakeholders to have trust in their reporting; this was known as the audit and assurance policy. For a full overview of the latest developments, see below.

Despite the clear step away from further regulation, there is still a need for companies to improve the quality of their audit reporting. In this blog we will outline the key areas companies will focus on to improve their disclosure in 2024.

The case for improving your audit reporting

While the appetite from companies and investors to simplify, rather than add to, the existing reporting regime is stronger than ever, the reform delays have received some criticism. A letter from a group of cross-party MPs and Peers to the Prime Minister outlined that “this longawaited legislation is vital to restoring trust in audit and corporate governance. The need for audit reform is now urgent… more than five years on we are deeply concerned about the pace of reform”.

There is broad stakeholder consensus that audit reform continues to be necessary to restore investor and public trust following the very damaging collapse of several high-profile businesses including Carillion, BHS and Thomas Cook. Investors continue to rely on the financial information presented in a company’s annual report and accounts to assess the quality and robustness of the audit and in turn make well-informed investment decisions. More work is needed as a quarter of major audits inspected required improvement in the FRC’s latest annual report.

According to the Investment Association, investors agree that the foundational aspects of a high-quality audit continue to relate to how the audit committee has judged the quality of the audit. In line with this, proxy advisors recognise the increased focus and complexity of the audit committee’s oversight of the external auditor. To reinforce this, some advisors, like the ISS, will note where four or fewer audit committee meetings have been held during the reporting period (for FTSE 350 companies).

How will companies improve their disclosure this year?

To stay ahead of the curve, we recommend improving your disclosure in line with the FRC’s Minimum Audit Standard. While voluntary for the FTSE 350, this standard is expected to become mandatory when the ARGA is set up via primary legislation (see above).

Focusing on Provision 26 of the UK Corporate Governance Code (2018), consider the following areas:

Auditor independence

As reporting is still quite boilerplate, we expect companies to provide a higher level of specificity when reporting on independence. To improve your disclosure, add detailed discussions on the safeguards used to protect the external auditor, such as:

- Restrictions on the employment of certain employees of the external auditor

- Rotation of the lead audit partner

- Independent professional standards review of the work carried out by the external auditor

Most companies report on their non-audit services policy, but do not outline the possible risk to an auditor’s independence where they are permitted to provide significant non-audit services that are not clearly audit related. In line with the FRC’s guidance, consider expanding on if the auditor was permitted to provide certain non-audit services in the year and, if so, why the auditor was considered independent despite providing those services.

Auditor effectiveness

Consider going beyond just an overview of the assessment of the auditor’s effectiveness. To enhance disclosure, include the following content:

- A list of issues considered.

- Any actions taken, with detail about the outcomes.

- How issues were factored into the committee’s conclusions.

- What the conclusions were.

There is a push to for companies to disclose specific areas considered when assessing auditor effectiveness, for example:

- The auditor’s mindset, character and culture.

- The levels of professional scepticism and challenge displayed by the external auditor.

- The number of meetings the external auditor had with the audit committee.

- The feedback from committee members and internal stakeholders (e.g. finance director or head of internal audit) on the external auditor.

- The levels of technical skills and experience of the external auditor.

- The response or engagement with FRC Audit Quality Review (AQR) reports.

It is clear that the need for audit reform has not gone away. While the pace of reform has slowed down, it is important for you to improve your disclosure in line with stakeholders’ interests and upcoming reporting requirements coming down the line.

Get in touch with us to discuss how you can take your audit disclosure to the next level.