The research cites that 79% of FTSE 350 companies regard technology and cyber security as principal risks, yet half do not disclose technology expertise on their boards.

Stay informed with regulations, insights & events by joining our mailer

Dealing with risks can be a daunting task as the economic environment becomes more uncertain and emerging risks are materialising quicker then ever before.

Running a business and pursuing strategic priorities, whilst mitigating risks and seizing opportunities, is a challenging balancing act that all companies must manage. It is fundamental that companies put investors’ minds to rest, by reassuring them that they have risk management covered.

So, how do you do this?

One way, which we feel compelling, is to clearly demonstrate the link between board skills and principal risks.

This is a practice which Grant Thornton’s Corporate Governance 2018 review highlights as worryingly “under communicated” by corporates. The research cites that 79% of FTSE 350 companies regard technology and cyber security as principal risks, yet half do not disclose technology expertise on their boards.

Whilst technology-related risks have spiked in recent years and companies are starting to take the necessary steps to bring more skills diversity into the boardroom, it is essential that companies also address risks such as climate change, which are also increasing in importance. Board directors must start thinking about what the next steps will be and what skills are needed to mitigate such matters.

When it comes to reporting skills diversity and risk mitigation, there are various ways in which it can be achieved:

Mention the link between risk and skills in your board evaluation

Companies may have to take a leap of faith and disclose whether a skills gap has been found on their board when conducting an evaluation. This should be followed up with any key actions or training in place to bolster the board’s experience in this area, ensuring the right knowledge is available at the top table. Investors need this level of transparency and assurance to build confidence.

Make graphs your friend

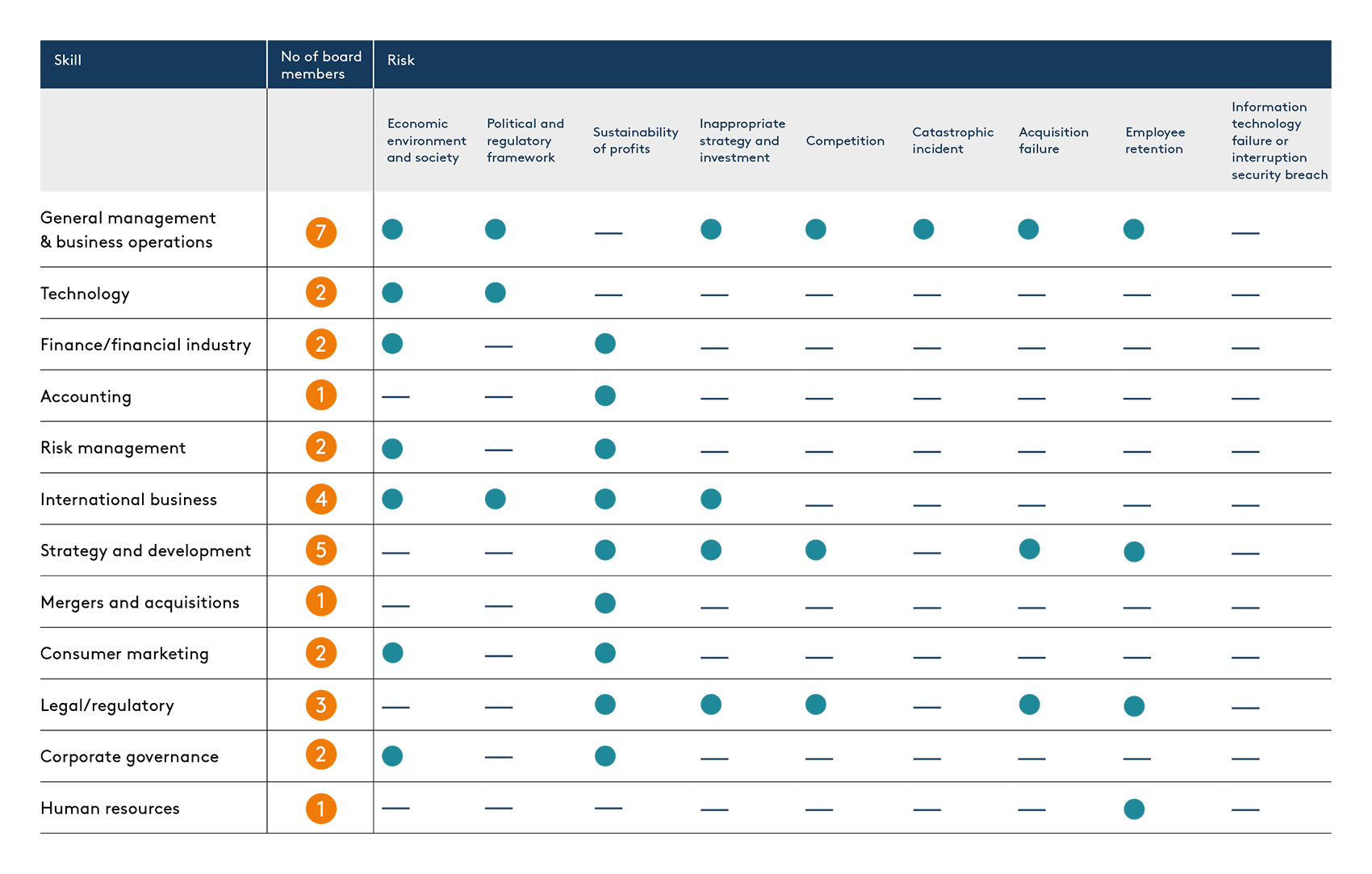

Tables, pie charts and heat-maps can be used to demonstrate a link between principal risks and board skills. This can be seen as a particularly risky disclosure (pardon the pun), as it really shines a light on the board room’s skills diversity. That said, if enough context is provided to support the disclosure and address how the board members receive regular information from individuals with the relative skills and expertise, this can be a ground-breaking initiative, helping to build trust with investors. We have included some designs to demonstrate how this information can be presented in the governance report.

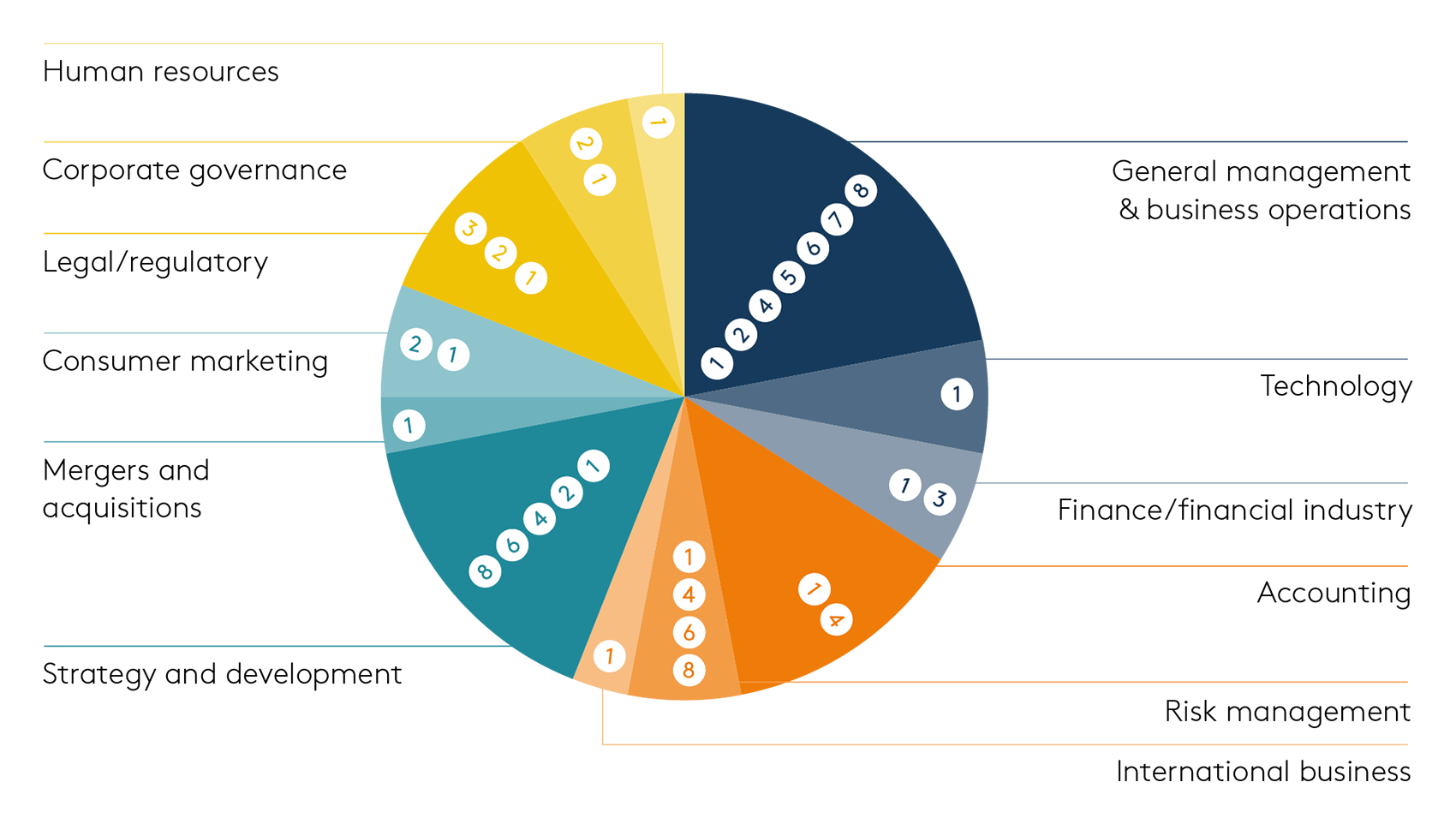

Each segment of the pie chart below represents the number of Board members which possess each skill. The risks which link to each skill are numbered and included in each segment. If there was to be a thin segment of the pie-chart with a lot of numbered risks in it, this would highlight a skill gap.

This table lists each principal risk across the top, with each key skill in the opposing column on the side. The number of Board members with each skill is in orange and the green circles show which risks are linked to each skill. If a small number of Board members possessed a skill which related to a large number of risks, this would present a skill gap.

Don’t shy away from mentioning external consultants and advisory boards

Whilst there may be discrepancies between board members’ skills and principal risks, this does not mean that companies are not ready to tackle such issues, by merging context and content to provide the right story.

It is becoming important now, more than ever, that companies take the bull by the horns and report on risk in a clear and concise manner, whilst highlighting how the company’s strengths can help mitigate such uncertainties. This is a chance for companies to tell their stories and reassure stakeholders of their responsibility to identify and mitigate any potential risks that may impact the company’s operational, financial and reputational status.

If you would like more specific help with reporting governance and risk, please contact daniel.redman@design-portfolio.co.